Archive for February, 2012

Scandal: Greece To Receive “Negative” Cash From “Second Bailout” As It Funds Insolvent European Banks | ZeroHedge Incredible. Greece was already only receiving $0.19 for every $1 in bailout funds. Now greece to receive ZERO bailout funds under 2nd bailout “agreement.” All funds to be used to pay off maturing bonds and interest. The kicker is that Greece will have to fund the very escrow account that is being set up to bail out Greece…So the ponzi continued with the Greek bailout being used as a vehicle to bailout insolvent European banks.

Posted by severinslade in Uncategorized on February 22, 2012

Tweet forwarded by @SeverinSlade

Posted by severinslade in Uncategorized on February 21, 2012

We are supposed to ignore q4

zerohedge: The Greek “worst case” scenario assumes just -1% GDP decline in 2013. GDP collapsed 7% in Q4 2011

Original Tweet: http://twitter.com/zerohedge/status/171819027717558272

Sent via TweetDeck (www.tweetdeck.com)

Tweet forwarded by @SeverinSlade

Posted by severinslade in Uncategorized on February 21, 2012

Carbon copy of bailout proposal that is almost 8 months old. It’s about 5 am Greek time and no official statement has been made on a new deal. I think it’s safe to say that even if we get a deal it’ll fall apart within days.

zerohedge: EURUSD Soars On Reuters Report That Greek Deal Is Reached… Which Is Same Deal As In July 2011 http://t.co/VSE9Wf6D

Original Tweet: http://twitter.com/zerohedge/status/171792441811275776

Sent via TweetDeck (www.tweetdeck.com)

Tweet forwarded by @SeverinSlade

Posted by severinslade in Uncategorized on February 18, 2012

zerohedge: The Latest Market Craze: Stock Trading Robots Reacting To Stories Written By… Robots http://t.co/F9GahvmT

Original Tweet: http://twitter.com/zerohedge/status/170621774432710656

Robots writing financial news articles that HFT algo robots then read, react to, and trade on. Skynet is taking over the financial markets. This won’t end well.

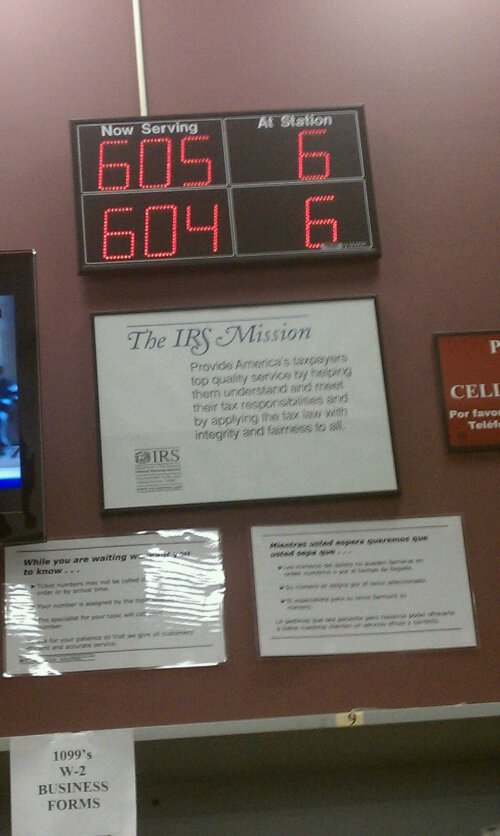

IRS

Posted by severinslade in Uncategorized on February 14, 2012

It should read “The IRS Mission: to steal from the American people for the benefit of the private Federal Reserve. I should be careful as taking pictures with your camera phone is highly suspiscious behavior. Someone call DHS pronto. If you see something you must say something.

How HFTs and an S&P downgrade broke the markets

Posted by severinslade in Uncategorized on February 6, 2012

The following chart is a visual representation HFT trading. Notice how insane trading becomes in August 2011.

If Jobs Were Being Added…

Posted by severinslade in Uncategorized on February 3, 2012

If jobs were being added, tax revenues would be climbing…Instead, they have turned negative.

Chart courtesy of ZeroHedge

NFP Number Really Down 2.9 Million Jobs Over Past 2 Months

Posted by severinslade in Uncategorized on February 3, 2012

From ZH:

“Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number,” adding, “Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs.” He wonders whether the BLS is being pressured during an election year to paint an overly optimistic picture by President Obama’s administration in light of these ‘real unadjusted job change’ facts.

Only the Ministry of Truth can manage to turn a 2.9 million job loss over two months into 446,000 new jobs GAINED.

For the record, TrimTabs tracks daily tax RECEIPTS by the government, which is much more accurately reflects the number of jobs added/lost. Of course the BLS doesn’t do this though, as it is not in the best interests of the current administration.

Greece Draws The Line In The Sand

Posted by severinslade in Uncategorized on February 3, 2012

Originally from the FT:

“All three party leaders in Greece’s teetering national unity government have opposed new austerity measures demanded by international lenders, forcing eurozone finance ministers to postpone approval of a new €130bn bail-out and moving the country closer to a full-blown default. Representatives of the so-called “troika” – the European Commission, European Central Bank and International Monetary Fund – have demanded further cuts in government jobs and severe reductions in Greek salaries, including an immediate 25 per cent cut in the €750 minimum monthly wage, before agreeing the new rescue. But representatives of all three coalition partners, including centre-left Pasok of former prime minister George Papandreou and the centre-right New Democracy of likely successor Antonis Samaras, said they were unwilling to back the government layoffs.“

Simply put, if Greece does indeed refuse to surrender their national sovereignty to the Troika (aka Germany), bailout funds will not be distributed…Meaning Greece will default.

The market clearly has failed to digest this, as the DOW is still up 142. But then again, with volume near record lows, all it takes is the idiot HFT algos to melt this market up.

Actual UI rate around 11.5%

Posted by severinslade in Uncategorized on February 3, 2012